In the past decades, the media has often been sprinkled by debates regarding the future of the pensions system. Almost every time, the debates revolve around the unsustainability of current system and the need for reform. There are a few ideas on how to deal with this problem, like reducing the value of pensions, increasing the retirement age or moving towards private pension schemes. Unfortunately, these are temporary solutions that don’t solve the deeper problem which created this situation, which is the accelerated population decline of the developed countries.

How does the pension system work?

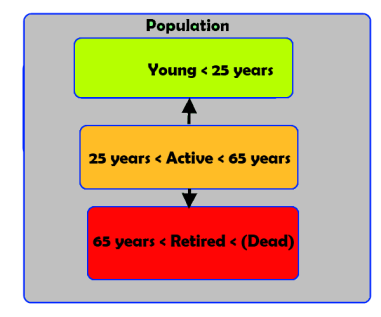

The pension system works like a loan between generations and is highly social in nature. To understand it, divide the population into 3 groups:

What you are being told

You are paying a contribution to a large, government controlled fund, which then redistributes your contribution to those who are retired.

How it really works

The public system

In a nutshell: The active population is paying for the education of the young population so that when the young become active, they will be able to support themselves, their family, have a better life and a decent income. In turn, the young population when it turns into active population returns the favour by paying for the pension of the former active population, which has now turned into a retired population. This scheme has sometimes been called – a loan between generations.

The private system

Your pension contribution is largely invested in government bonds, since they’re the safest bet for maintaining the value of your contribution. Also, a small percentage of your contribution is used for financial investments. These investments can take many forms, but it’s not uncommon to be gambles on the stock market. The result is that your contribution is kept at a relatively fair value so that when you retire, you can get a good pension. The downside is that the company that invested your pension may go bankrupt and you are left with no pension or have your pension drastically reduced. This has actually happened in Argentine (2001) or with some pension schemes in the US and UK: example.

The mixed system

Throughout your life the state takes a certain percentage of your monthly salary and uses it for long term investments. These investments maintain the value of your initial contribution over long periods of time. After you retire, your contribution is returned to you in the form of pension. The value of your pension is calculated depending on the overall value of your contribution.

So what’s the problem?

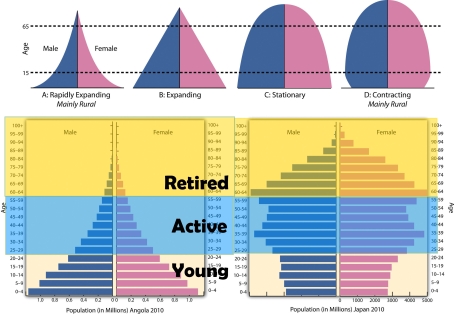

The problem is related to how the overall social and economic system works. The above pyramids highlight the 3 areas of the population: the young, the active and the retired.

In the developed countries, up to the 1970s, the distribution of the population was similar to the one in Angola: a small peak representing the retired population, a large middle section representing the active population and a large base representing the young population. Today, in the EU and in the US, the peak is becoming larger and larger, while the middle and bottom sections are gradually becoming smaller. As a consequence, the middle section is having a hard time coping with the (financial and economic) pressure exerted by the upper section.

One of the long term solutions is to de-couple the retired population from the active one by developing pensions schemes (be they private or public), which act like saving accounts for the population. Unfortunately, in the large scheme of things, it doesn’t really matter how you package the pension, since the economic and financial needs of the retired population still need to be fulfilled one way or another by the active population. The retired population is (in theory) a pure consumer, it doesn’t generate wealth and thus the state still needs to support itself from the active population (which is becoming smaller and smaller). In the same way, the interest generated by private pension funds is also highly depended on how well the active population is doing. The private pension funds generate their income and profit by investing in the activities of the active population and thus are depended on it for maintaining the value of your pension.

As a consequence, regardless of how you look at the problem, the current pension system is in difficulty, because the active population is unable to generate the economic wealth and financial resources needed to support the retired population at current levels. The short-term solution is to adjust these levels, either by reducing the value of pensions or by increasing the retirement age, thus reducing the number of people retiring every year.

Another quick way out of this situation is to increase the pool of the active population through immigration. Additionally, in developed countries, immigrants have the tendency of making far more kids than the local population (source), further strengthening the bottom sections of the population pyramid. This is a fair and decent solution for the survivability of the country, but it also marks a turning point in its society, because basically what is happening is that the local population is slowly being replaced by a new, foreign population.

The ideal solution?

The ideal long-term solution is when the population remains stable over-time. This means that every year, the number of people who die must be almost equal to the number of new-borns. Thus, the population doesn’t change fundamentally over-time and it’s able to sustain itself. To have a stable population, a country requires that the local population has a fertility rate of 2 (basically each woman has to have 2 kids in her life-time). By comparison, in most developed countries fertility rates are very low, in Japan for instance, the fertility rate is 1.39. There is no indication that fertility rates will increase in the foreseeable future, and most of the current increase in fertility rates is the result of immigration, since immigrants usually have a fertility rate between 2.25 and 2.5.

P.S. Another (but far-fetched) solution is to discover means to increase the life-span of the population and maintain its youth for much longer periods of time. Sci-fi as it may seem, it does make the entire argument regarding pensions and population distribution entirely mute, since in world where everyone is young and eternal, such an argument is meaningless.